BACK

BACK

The Changing Nature of Coincident Peak Events – and How to Stay Ahead

As electricity markets evolve to accommodate rapid changes in both supply and demand, grasping the changing nature of coincident peak periods can be complex – and richly rewarded. Coincident peak demand can be one of the most critical cost components for large energy users in markets where utilities or regulators analyze it to allocate costs to customers.

Defining Coincident Peak Demand

Coincident peak (also referred to as “system peak”) demand refers to the period of maximum demand for electricity that occurs simultaneously across a utility’s service area. This maximum demand dictates how much energy capacity must be available to meet peak periods. This figure is important to grid operators in the long term because rising demand trends can indicate the need to invest in more generation infrastructure. But it’s also a critical figure in the immediate term: just because the grid is built to serve a given capacity does not mean it’s meant to serve that capacity. Ideal grid operations maintain a buffer between capacity and demand, called capacity margin. Coincident peak programs are designed to send price signals to large energy users in the form of (often hefty) demand charges on their monthly utility bills, incentivizing them to scale back usage during system peaks to allow the grid to maintain its capacity margin.

Because coincident peak programs are relatively easy to administer and they have proven to be fairly effective at managing demand, hundreds of these programs exist throughout the country, behind large investor-owned utilities (IOUs) as well as municipal utilities and rural electric cooperatives. Programs vary in structure and administration: 4CP in the Electric Reliability Council of Texas (ERCOT) and 5CP in the Pennsylvania-New Jersey-Maryland Interconnection (PJM) get their names from the number of coincident peak intervals per year (four and five summer intervals, respectively), whereas other programs may identify a coincident peak each month, or a single annual peak. For single-site operations, or those in regulated markets that may not have an energy desk or track real-time pricing, coincident peak charges can easily be overlooked for far too long.

The Evolving Challenge of Predicting Utility Grid Peaks

The dynamics of electricity pricing have shifted dramatically in recent years, making it more challenging to anticipate system-wide peaks without the help of predictive models. Grid transitions like the influx of solar power on the supply side and large flexible loads on the demand side require much more sophisticated insights and data inputs than even just five years ago.

During daylight hours, the prevalence of solar power in certain grids has driven wholesale prices down – even into negative territory (most notably in Texas) – when production exceeds demand. However, as the sun sets in the early evening and solar generation decreases, prices can spike dramatically as more expensive generation comes online. This “duck curve” can be mitigated with the deployment of more battery storage, but that storage can also make it even harder to predict when a coincident peak interval will occur.

On the demand side of the equation, growth in large flexible loads is adding a layer of complexity to predicting system peaks. Flexible load refers to any type of electrical load that can be interrupted with minimal consequence during times of high demand, such as air conditioning or water heaters, etc. But large flexible load often refers to cryptocurrency mining, which uses lots of energy but can be quickly curtailed. If a grid is approaching a system peak and enough large flexible load curtails, the system peak is avoided.

Accurately predicting when utility grid peaks will occur presents a significant challenge, even more so as weather patterns become more unpredictable. Factors such as temperature fluctuations and extreme weather events complicate demand forecasting even further, making it difficult for companies to anticipate peak times and adjust their energy usage accordingly. As an extreme example this past summer, hurricane Beryl reduced the July peak in Texas compared to 2023 – and dramatically altered its timing – by knocking out a significant part of the ERCOT grid.

Predicting the Peaks

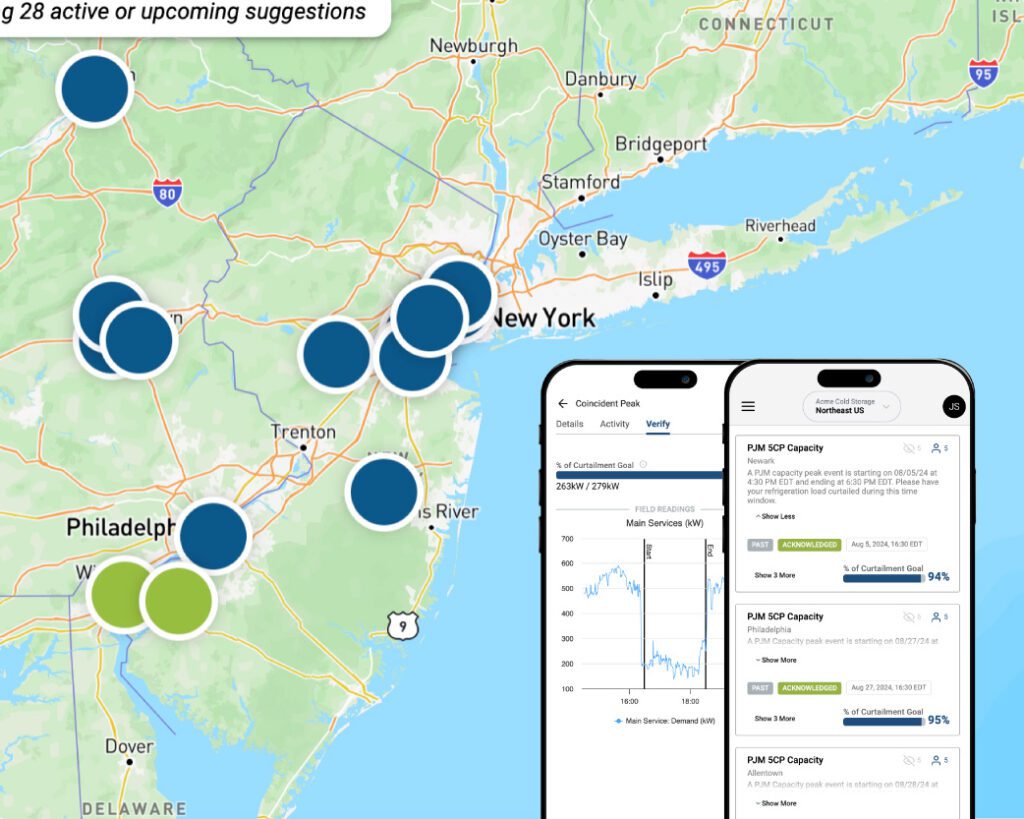

To address these challenges, Ndustrial has been a pioneer in developing software that helps industrial customers navigate the complexities of coincident peak demand. Using a proprietary Machine Learning algorithm, our solution analyzes extensive data to accurately predict utility peaks and provide real-time alerts. And to reduce alert fatigue (yes, it’s real!), we tailor our suggestions based on the risk tolerance of each of our customers’ operations.

Our customers have reaped the benefits, experiencing:

- Market-Specific, Industry-Specific Curtailment Alerts: At Ndustrial, we understand that production is the priority for our industrial customers. So we tailor our predictive algorithms to optimize savings with fewer curtailment hours called and less disruption to customer business operations.

- Exceptional Performance Metrics: Customers have achieved over 90% accuracy on 2-hour prediction windows and over 80% accuracy on 1-hour windows, up to 7 days in advance in some cases. This allows them to schedule intelligent operational changes that lead to significant cost savings. A single customer site in Tar Heel, North Carolina saved hundreds of thousands of dollars – more than 15% on its total electric bill – in 2023 by curtailing during coincident peak intervals.

Execution is Everything

Predicting grid peaks is just the first step. Industrial facilities also need to execute by curtailing demand when the coincident peaks are most likely to occur. Failure to execute, even by delaying 15 minutes or powering equipment back up too early, can erase all potential savings. Ndustrial has helped customers improve the performance of their demand curtailments by setting targets for each facility and then verifying how much demand was curtailed during each event and the impact to their demand charges on future utility bills. This is done in real time so that operators at each facility get feedback about how they are performing and stakeholders like general managers, finance teams, and energy managers are fully aware of cost reduction efforts and can budget accordingly.

Strategies for Avoiding Peak Demand Charges

The ability to navigate costly coincident peak intervals requires more than just accurate prediction and real-time alerts. To mitigate peak demand charges during crucial coincident peak intervals, large energy users can implement several strategies:

- Get to Know Your Load: By deploying submeters to monitor and analyze electrical load, companies can discover how much energy each area of the facility or piece of equipment consumes. Then they can identify ways to curtail certain loads at optimal times and determine the maximum amount of curtailment that makes sense from both a business and energy perspective.

- Set Curtailment Goals: Based on operational considerations, set targets for how much load can be curtailed and what the cost savings would be if these targets are met during coincident peaks.

- Establish a Curtailment Plan: Each facility should document the best practices and procedures for equipment operators to follow to meet curtailment goals. This should include safety factors so that equipment is shut down and powered up in a way that does not damage equipment or put anyone in danger. The plan should also consider any factors that could risk operations. For example, a cold storage facility should consider what temperature sensors should be monitored during curtailment events to avoid any temperature compliance issues. This can also include any changes to personnel shifts that should be scheduled around facility downtime during the curtailment. The plan should be shared with everyone who needs to take action or who may be impacted, such that the entire team is aware of the best practices for a successful curtailment event.

- Deploy Distributed Energy Resources (DERs): Technologies such as behind-the-meter solar and wind, battery storage, bi-directional EV chargers, fuel cells, or back-up generators can be harnessed to reduce grid consumption during peak hours or to store excess energy generated during the day for later use.

- Practice Load Shedding or Load Shifting: Adjusting operations to minimize energy consumption during peak periods can significantly lower demand charges. Companies can shift production schedules to non-peak times, stagger start times for high energy use equipment, or turn off non-critical equipment during peak intervals.

- Measure Results: You can’t improve what you don’t measure. This is especially true for reducing coincident peak demand charges. First, each facility or region that is subject to coincident peaks should assess how well peaks are being predicted. Are all the peaks being covered? Are too many curtailment events being called, negatively impacting operations? Second, each facility should assess curtailment execution to make sure that target goals are being met. Which facilities are having trouble curtailing? Are they curtailing too late or powering back on too early? Are they curtailing the right equipment? This will help identify where the lost savings are occurring and improve future results.

Conclusion

As electricity markets evolve to integrate renewable resources and flexible loads, the ability to respond quickly to coincident peak signals is crucial for industrial companies. By leveraging distributed energy resources, load shedding / load shifting, and advanced predictive analytics, businesses can effectively minimize peak demand charges. Energy Intelligence™ , involves both advanced analytics and guidance from real humans. This empowers customers to optimize their energy consumption, giving them a competitive edge in a rapidly changing energy market. At the same time, it helps companies reduce emissions while contributing to a more resilient and responsive grid.